A peek inside this post: Homemakers who manage the finances have a big responsibility. Do you need a better system for organizing family finances? Don’t miss this life-changing budget for homemakers that will save you time, stress, and hopefully… money!

It’s a big task to take on the responsibility of managing the family finances.

You want to make sure you are being a good steward of money, that your people are fed, clothed, and have everything else they need… and some of their wants, too!

In an effort to help your home (and finances!) thrive, I thought I’d share a few things I’ve learned in organizing my family’s finances, including a simple budget spreadsheet for Google Sheets I created and have used for over 5 years.

This budget for homemakers will revamp the way you manage your household income and expenses! If you’ve been looking for a done-for-you budget that will leave you FREE of stress, headaches, and overwhelm, you’ve come to the right place.

Table of Contents:

5 Reasons Organizing Family Finances is Important

How to Use Our Budget Spreadsheet

Get Access to this Life Changing Budget for Homemakers

5 Reasons Organizing Family Finances is Important

Budgets are extremely important for families. By keeping a close eye on your money, you can have peace of mind while planning for your future.

There are many great reasons to create a budget today.

1. It creates freedom.

Instead of thinking of a budget as being a restriction, think of it as working towards freedom. Once you’re in control of where your money is being spent, you can choose what’s important to you.

Do you live month to month, just able to pay your bills? Do you want to get out of this cycle?

It can be possible to feel freedom on any income if you stick to a budget and make priorities.

What are your family’s goals? What’s important in your life?

By setting up a budget, you can figure out what goals are a priority, when you want to accomplish these things, and feel empowered once you reach them!

The biggest challenge in working towards financial freedom is getting caught up in consumerism.

Almost everyone struggles with it in our society! Marketers are so good at talking us into believing that we need something.

I’m not a big shopper and I feel like I’m a pretty content person, but when I walk through Wal-Mart picking up some necessities for my family, I still walk by 20 different non-essentials and am tempted to buy them because of how they will “enhance my life.”

It’s my goal to not give into this temptation too often. I don’t often budget for these extras. I don’t actually need another soft blanket, an air fryer, or that cute new sweater.

But man, they sure make you think you need it all.

By budgeting, you achieve freedom from the debt these things can put you in. You can set aside some money for these extras, and decide intentionally if you want them that much and if you have the space in your home for them.

Live life with eyes wide open! Make a budget and feel the beautiful freedom that comes with it!

2. It allows you to give generously.

When you create a budget for your family, you’re able to think of how you can give to others in need. You can easily see what amount you can afford to give regularly, and also may have money available to give randomly as you see a need as well.

For where your treasure is, there your heart will also be.

Matthew 6:21

What are you counting as your treasure? If you’re in a financially difficult spot, then your whole life can be tough. It adds so much stress.

But, if you’re in a financial position to give generously to the things God puts on your heart, then the freedom you feel is incredible!

It can take some time getting to a position of financial freedom, but after years of intentional living and budgeting, you can feel the benefits of all your planning, God willing.

What is God putting on your heart to give? Where is He leading your heart?

How can you structure your life and priorities to serve God with your money? It could turn into so much more than making a simple donation. It could change your life and what you do with your time.

Setting up a budget allows you to GIVE to the things you’re passionate about! Where is your heart leading you?

3. It honors your and your husband’s hard work.

You and your husband both work hard. You might as well honor that hard work and tell your money where it will go, rather than it disapearing without a plan.

With a financial plan for your family, you can feel like your and your husband’s hard work is worth the effort when you’re in charge of where your income goes each month.

Also, I definitely suggest being on the same page with your hubby about where and how you spend your money. This is one of our tips in 7 Keys to a Healthy Marriage.

Without communication about your family financial plan, it’s not likely to be successful.

4| It’s a valuable skill to teach your kids.

Teaching your kids to budget is one of the best gifts you can give them for their future.

Each family does this a little differently, but I encourage you to find a way that’s best for you and your family.

If you choose to give your kids an allowance, help them determine what their money should be used for. One idea many people use is the Give 10, Save 10 Rule: have them put 10% into their savings (not to be used until a certain age), 10% to giving, and the rest is for spending.

Since my kids are young, my husband and I haven’t implemented an allowance yet, but this is something we plan to start with our older two this year. We want to teach them how to wisely use their extra money, and how to budget to save up for things they really want.

>> Looking for the Best Chore Chart System (including allowance)? Don’t miss this idea from one of the other Homemakers on this blog!

We’ve often told our kids that some things are too expensive to purchase (toys, games), but they still don’t have a good grasp on what $100 can buy. By giving them an allowance, we hope to give them an understanding of how long it takes to save up for these big ticket items.

Each year, kids should be given more responsibility to make these choices on their own, and to learn from any mistakes they may make. What better way to learn than life experience, right?

5| It creates security.

Being a good steward over your money establishes some security for your life.

If you live within your means and make wise decisions with your money, it’s unlikely that you will face hardships that you can’t recover from financially.

Of course, there are always curve balls we didn’t see coming. But planning ahead and having extra money set aside for emergencies and unforeseen circumstances is one thing we can do for our future selves.

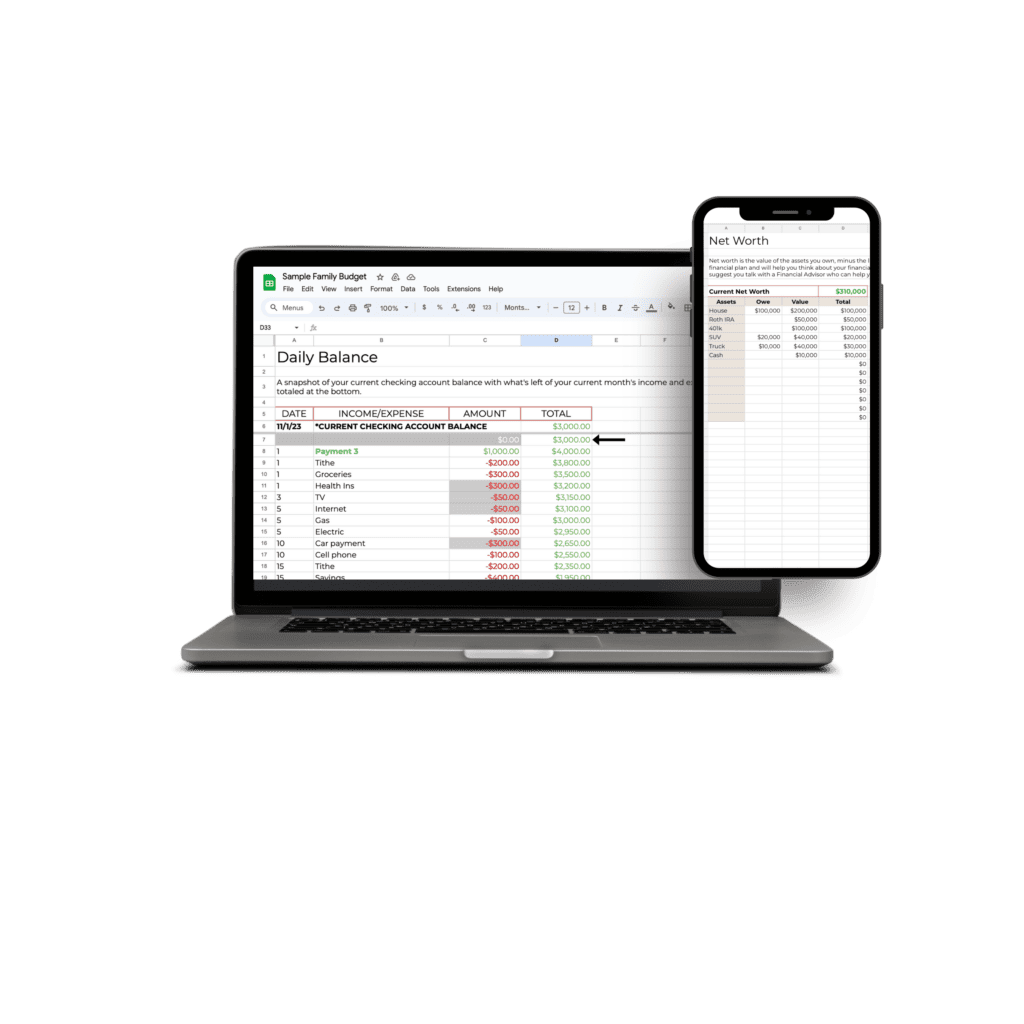

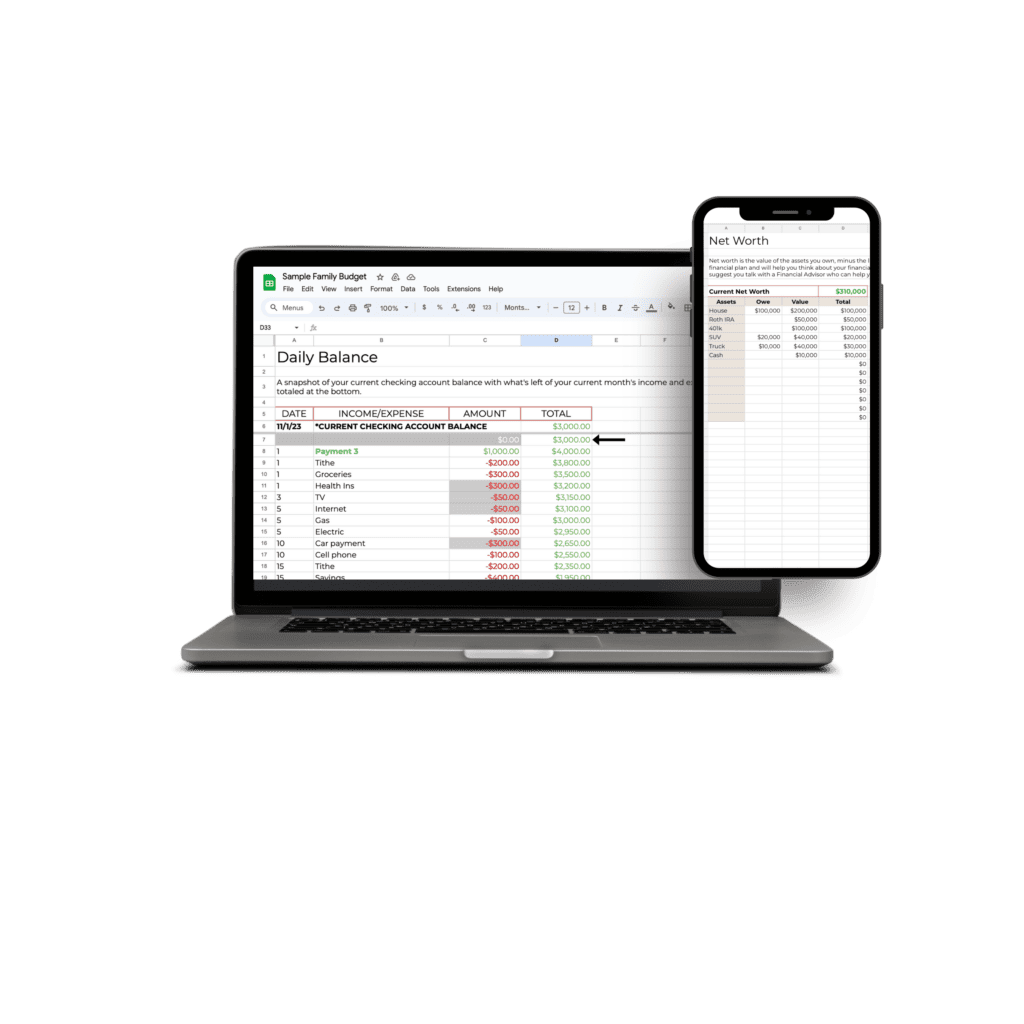

How to Use Our Household Budget for Google Sheets

This budget spreadsheet can solve several problems for you. Use it to:

- keep track of your Daily Balance (so you always know exactly how much money you’ll have in your checking account after bills are paid).

- make sure all of your bills are paid on time, month by month.

- adapt to changes in income/expenses- add or delete items easily.

- create goals and track them so you can prepare for your future.

Watch this quick video tutorial:

You can also fully customize this spreadsheet.

Add tabs at the bottom. Maybe you want to record Bill Payment Confirmation numbers or have a separate tab for your savings account.

Don’t be afraid to alter the payment schedule for however it works for you, too. Maybe your income is paid weekly or biweekly instead of twice a month. Do whatever you need to do to make it work for you, and don’t be afraid to reach out if you have any questions!

Get Access to this Life-Changing Budget for Homemakers

Like I said, I’ve been using this Budget Spreadsheet for over five years. I’ve changed a few things over time, but it has given me peace of mind to know that all my bills are paid on time.

It has also helped me to figure out our family’s priorities and set big goals that we want to reach.

This spreadsheet is:

- Easy to use (if you have basic spreadsheet knowledge)

- Customizable & versatile to suit your individual needs

- Easily accessible with a free Google account (via Google Sheets)

>>> You can buy the budget as a stand-alone product. It’s also included in our Homemaking Course, along with some other helpful products, including a Meal Planning System and a Cleaning Planner.

>>> Ready to get your budget spreadsheet and completely revamp your family finances?

Budget Spreadsheet for Google Sheets

**When you open the spreadsheet you will be asked if you would like to make a copy of the “Sample Budget Spreadsheet.” Click “Make a Copy” to save it to your Google Drive.

OR

Check Out our Homemaking Course to get this budget spreadsheet & more

Hope You Love this Budget for Homemakers!

My prayer for you is that you don’t allow your money to limit you. But that you take control by living intentionally with your finances so you can achieve your goals!

If you’re looking for a refresh, download our budget for homemakers to help you have peace of mind with your bills and goals.

If you have any questions or concerns about using this budget spreadsheet, please don’t be afraid to reach out! Let us know how it’s working for you in the comments!

Read Also:

How to be Frugal With Groceries: Tips for Homemakers on a Budget

Simple DIY Castile Foaming Hand Soap for Pennies

5 Ways to Save BIG on a Family Road Trip on a Budget

The Top Homemaking Skills You Still Need (even though they’re old-fashioned)

I love this spreadsheet, but how do I adjust the yearly tab for bi-weekly paychecks? It’s really frustrating to figure out which of my bills get paid when because my payday is kind of a moving target. Thanks for your help!!

Hi Beth! I can see how that would be difficult. Can you just do one row for “income” in the “Bill Payments” tab, then you can say what your total monthly income is expected to be? That will help you plan for your montly totals.

Then in the first tab, “Daily Balance” you could add the specific dates you will be paid and how much exactly. Would this work for you?

Hey, Beth! I had to adjust this spreadsheet to work for my husband’s biweekly pay schedule, too. Would you like me to email you a copy of mine so you can see how I made it work?

Thank you! 💓 May the Lord refresh you. 💦🙏😍

Thanks for reading along, Minnie!